No Win, No Fee

There is no upfront fee, if your claim is unsuccessful.

you pay nothing.

Marriage Allowance

Allows you to transfer 10% unused personal allowance .

from low earning partner to the higher earning partner

Eligibility

Use our refund calculator to see if you.

meet the criteria required

What is Marriage Tax Allowance Refund?

This is an initiative the government introduced in April 2015, to help couples and civil partners reduce their tax bill. This involves the lower earning Partner within the marriage or civil partnership to transfer 10% of their personal allowance to the higher earning partner.

The 10% is equivalent to £1,250 annually which is transferred to the higher earning partner. In Other words, it would reduce the higher paying partner taxable income by £1,250, reducing their annually tax paid by £250, and a refund for overpayment in tax for the past 4 years worth over £1,000 as long as the civil partnership existed over the period.

This is legal government scheme but requires an annual self-assessment and to notify HMRC of your situation to make full use of this allowance. The Government allows a backdated claim, from 2015, last 4 years, which is equivalent to £1,000 in refund.

Transferring Personal Allowance

Everyone has an annual tax-free personal allowance, which currently stands at £12,500. This means the first £12,500 of their income is tax free. Marriage tax allowance allows the lower earning partner to transfer their unused allowance up to a max of 10% to the higher earning partner.

Giving the higher partner the benefit of reducing their tax bill annually by £1250, + also getting a refund for overpaid tax in the past 4 years which is £250 a year. And £1,000 for the past 4 years.

HMRC Eligibility?

Marriage Allowance is an elective tax break, meaning that eligible couples will not receive the tax allowance unless a claim is made. If no claim is made, then the entitlement is simply written of with the funds being retained by the Government.

The Government has been criticised by experts for failing to publicise the Marriage allowance, with 90% of couples being unaware of the tax break scheme.

If you are in civil partnership, you could be due back up to £1000 back in Marriage allowance Tax refund.

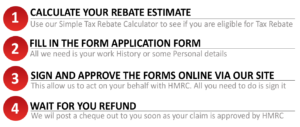

How Do I Claim a Tax Rebate?

Don`t worry , the tax rebate process does not require historical data / receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more