What is work tool tax refunds?

If your industry requires employee to pay for their own work tools, you may be able to claim back Tax Relief. There are 2 main ways to claim , firstly using a Flat Rate. Expense (FRE) Calculation and secondly a Capital Allowance method. The main difference is the amount you can claim and whether or not you have got all your receipts.

Capital Allowance Tools Rebate

If you have all your receipts then Capital Allowance will allow you claim 100% of your expenses if your employer has not paid you back.There is an upper limit of £2500 per tax year after which you have to use Self Assessment Forms.. This should be done within the 4-year time frame from the end of the tax year.

However, if the employer has already reimbursed the employee, then they cannot claim for this expense again.

Are Receipts required?

Yes, this is to prove your purchase, and amount spent. If receipts are lost, you may only be able to claim the FRE Allowance. If the tools are on a finance agreement, then you can still claim back the tax relief plus a bonus of claiming back the tax paid on the interest. For this a copy of the finance agreement will be necessary.

Flat Rate Expense work tool allowances?

The government has a “Flat Rate Expense” (FRE) for employees who can claim upto £120 per tax year of their spending on tools. This is the option majority go for and is the more successful, FRE still requires you to submit receipts of the purchases and again you will be NOT able to claim if your employer has already reimbursed you for these costs. Please use our calculator to work out your estimate.

When am I not Eligible?

You are not eligible if you have not paid enough income tax, also you are not eligible if your employer has already reimbursed you for the costs.

Can I Claim for anything else?

You could check our Uniform Tax Allowance page for more information, on how to get uniform tax rebate.

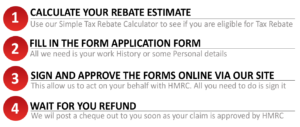

How Do I Claim a Tax Rebate?

Don`t worry , the tax rebate process does not require historical data / receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more