Have you received your PPI Payout ?

Payment protection insurance (PPI), was designed to cover repayments in certain circumstances where you couldn’t make them yourself. These included if you were made redundant or couldn’t work due to an accident, illness, disability or death.

As many as 64 million PPI policies were sold in the UK, mostly between 1990 and 2010, some as far back as the 1970s. The majority of these policies were mis-sold, complaints started in early 2004 and the scandal received new prominence in 2005 when Citizens Advice issued a so-called super-complaint to competition watchdogs about what it described as a “protection racket”, starting a series of events that led to the compensation payments to consumers and sales of some types of PPI being banned.

As of August 2019, banks, building societies and other credit providers had paid an astonishing £36bn in compensation to those who were mis-sold PPI and made a claim. The typical payout was £2,000.

Example

If an employee (mechanic/engineer) buy’s a work tool to carry out their job, let say the tools total cost was £1000, you will be able to claim back £200 tax refund, this subject to the claim being approved by HMRC. This should be done within the 4-year timeframe from the end of the tax year. However, if the mechanics employer has already reimbursed the employee, then they cannot claim for this expense again.

The money you get paid back for PPI claim can have up to three main elements:

- A refund of the PPI you paid.

- If the bank added an extra loan to your original loan just to pay for the PPI, you get back any interest you were charged on this extra loan.

- You get statutory interest (at 8% a year, but not compounded) on the total of both those sums, for each year since you got the PPI.

Of these, only the third element is liable to be taxed (usually at 20%). This is usually shown on the pay-out statement.

Why you may be owed tax back on PPI pay-out’s interest

If tax is due on PPI pay-outs, most lenders will have deducted it automatically at the basic 20% rate before you get the money, but if you are a non-taxpayer then you have the right to claim all of the money back from HM Revenue & Customs (HMRC).

In April 2016 the personal savings allowance was introduced which allows taxpayers to earn up to £1,000 a year tax-free on their savings which includes the statutory interest paid on PPI claims.

Since then, while most savings interest has been paid ‘gross’, ie, without any tax being taken off, PPI still has 20% automatically deducted.

And as PPI is taxed as a lump sum payment at the point it is paid, most people who have paid tax on PPI pay-outs since then are entitled to some money back.

Tax is deducted at the basic 20% rate, so for every £100 of statutory interest you earn, you pay £20 in tax. To give you an idea of how it relates to the size of PPI pay-outs see the chart below – but there are many other factors.

The tax you can reclaim on pay-outs after 6 April 2016

The PPI pay-out is taxed in the year it is paid, so even if you took out a PPI policy in, say, 2004, if it was repaid in 2016, it’s that later tax regime that counts.

If you were a non-taxpayer in the year the PPI was paid out (eg, currently that means those earning less than the £12,500 personal allowance), unless the statutory interest pushes you over the taxpaying threshold, you can claim all the tax back.

For most taxpayers, as well as the normal income-tax personal allowance, since 6 April 2016, the personal savings allowance is a further specific amount you are allowed to earn tax-free just on savings interest:

- Basic 20% rate taxpayers (earning c. £12,500-£50,000) can earn £1,000 in interest a year tax-free.

- Higher 40% rate taxpayers (earning c. £50,000-£150,000) can earn £500 in interest a year tax-free.

- Top 45% rate taxpayers (earning over £150,000) don’t get a personal savings allowance.

If the total interest earned from savings and PPI statutory interest is less than your personal savings allowance, you are due all PPI tax paid back.

You can only claim back four tax years, as well as the current one, which means the furthest you can go back is the 2015/16 tax year.

Claims for PPI payments received before April 2016

As basic-rate taxpayers should’ve been paying 20% tax, and that’s what was automatically deducted, there’s nothing to claim back. Yet non-taxpayers or those earning just enough to pay tax but not much more, so were on the starting savings should be able to reclaim some or all the tax on this just like other savings income.

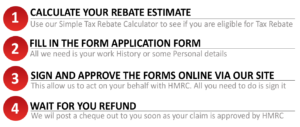

How Do I Claim a Tax Rebate?

Don`t worry , the tax rebate process does not require historical data / receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees tax refunds and many more..