What is Mileage Allowance?

If you drive your personal vehicle for work related travel, you could be due a tax refund. However, this does not include travelling from home to work.

A lot of Employers do not reimburse their Employees the full HMRC set amount which is 45p per mile for the first 10,000 miles in a car or van and 25p per mile for any miles over 10,000. This amount is set by HMRC and is there to cover fuel and other vehicle costs. HMRC are aware of employer underpaying and allow you to claim back the difference. You cannot claim for, Congestion charges, ULEZ charges, Tolls, Parking, or VAT on any of these.

Mileage allowance reduces your taxable pay, so works like a refund, reimbursing you for overpaid tax.

Define business mileage?

Business mileage is any mileage you incur in fulfilling duties of your job, its does not include travelling from home to permanent workplace. However, if you are travelling to different site/sales visits from home rather than your normal permanent workplace, this is eligible.

What if my Employer already reimburses me?

You may still be able to claim depending on how much your employer pays you per mile. HMRC has set out a rates table for cars, van, motorcycle and trucks which can be found on their website. The difference can be claimed, you do not need to calculate anything, our calculators will automatically calculate what you may be able to claim.

How much can I Claim back?

Using our Calculator, you can find out how much you are estimated in rebates. You must claim within 4 years since the end of the tax year. This means you can claim relief on all work related mileage incurred since 6th April 2016. We offer a No Win / No Fee Claim Process.

What Information do I require

– The date of travel

– The total mileage covered per individual journey, including a start and end address

– reason for the journey

– Whether you incurred any other expenses, such as parking

– What car were you driving, company car does not qualify

– The mileage rate paid by employer.

How Do I Claim a Tax Rebate?

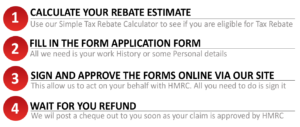

Don`t worry , the tax rebate process does not require historical data / receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more