Who Can Claim Job Uniform Rebate

If you have to pay for washing / repairing your Job Uniform then you could claim a tax rebate

All of the following conditions must apply

i) You wear a uniform that denotes you’ve got a certain job, even a branded T-shirt,Fast Food , Couriers, Nurse , Porters etc

ii) Your employer requires you to wear it while you’re working and does not pay you for it.

iii) You have to purchase, clean, repair or replace it yourself. However, you can’t claim if your employer provides facilities to do so (even if you don’t use them) or pays you for doing this maintenance.

iv) You paid income tax in the year that you are claiming

You cannot claim if you are self employed , you should use your self assessment forms

Do I need Receipts

No Receipts required, The government has made it easy to claim by setting a standard rate according to your work industry

How Much Could I Claim

The actual amount of Tax Relief will depend on your Industry from standard £60 per annum to as high as £250 for certain industries

Can I claim for more than 1 job

Yes, You can claim for mutliple jobs within the last 4 years

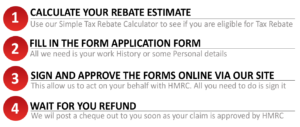

How Do I Claim a Tax Rebate?

Don`t worry , the tax rebate process does not require historical data / receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more