What other Tax Rebates are available?

There are may Tax Refunds from Government Tax Schemes for employees. Most of these require detailed analysis and cannot be completed online.

Pension payments

Income from a life or pension annuity

A redundancy payment

A Self Assessment tax return

Interest from savings or PPI

Foreign income

UK income if you live abroad

If you think that any of the above may apply to you, then use our query page to start your claim

How Can I Claim

First stage is to send a query by using our Conatcs page then we will gather some Data from you to assess eligibility. If Eligible then we will start the claim process on your behalf.

How long does it take?

Claims usually take 6/8 weeks .

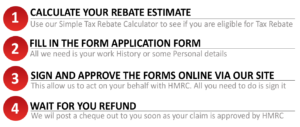

How Do I Claim a Tax Rebate?

Don`t worry , the tax rebate process does not require historical data / receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more