Who Can Claim Subscriptions Rebate

If you have to pay professional fees or subscriptions as part of your job then you can claim a tax rebate

Subscriptions And Professional Fees

Tax reliefs are available on fees and subscription costs to many professional bodies, including NUT and NASUWT. HMRC has a maintained list of approved professional bodies that are eligible for tax relief. The amount you can claim back in variable depending on the agreement you have in place. It is usually the 20% tax amount that can be claimed back.

Cannot Claim Subscriptions Rebate if

If you have not paid for fees yourself or if you have a lifetime membership

Which Professions Can Claim

We have processed claims from all sorts of professions especially Teachers , Mechanics , Union Members etc

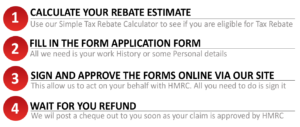

How Do I Claim a Tax Rebate?

Don`t worry , the tax rebate process does not require historical data / receipts. We have kept it very simple , use our online calculator for eligibility , then just complete a few basic questions on our online form and we will do the rest. As your Tax Agent , we deal with all queries from HMRC and you receive a tax refund cheque in the post.

Employee Tax has a proven record of dealing effectively on behalf of our clients to recover taxpayer money for Job Uniforms Tax Refunds, Marriage Allowance Tax Rebate, Tool Allowances Tax Rebates , PPI Refund Tax Rebates, Mileage Allowance Tax Refund, Magazine Subscription Allowances Tax Refund, Union Fees Tax Refunds and many more